Nvidia with Mercedes-Benz

On Tuesday, NVidia, a powerhouse store of videogame chip, made an announcement of a partnership with Mercedes-Benz, renowned to be the maker of the world’s most luxurious cars. The partnership came up with an idea of redesigning its entire fleet of cars in wake of the software-defined computing network with over-the-air updates and recurring revenue of applications. In a delightful way, NVidia CEO stated that “This is the iPhone moment of the car”.

Supporting the partnership, he said that this the trust investors have put in the company over the past 5 years of transformation. This is the reason the stocks have multiplied 18 times in price over the period.

The Nvidia has done major transformation in the field of gaming when gaming was not a thing. Nvidia will be worth an estimated $6.1 billion in revenue. But there’s much more to the company than the shown worth.

Origin of NVIDIA

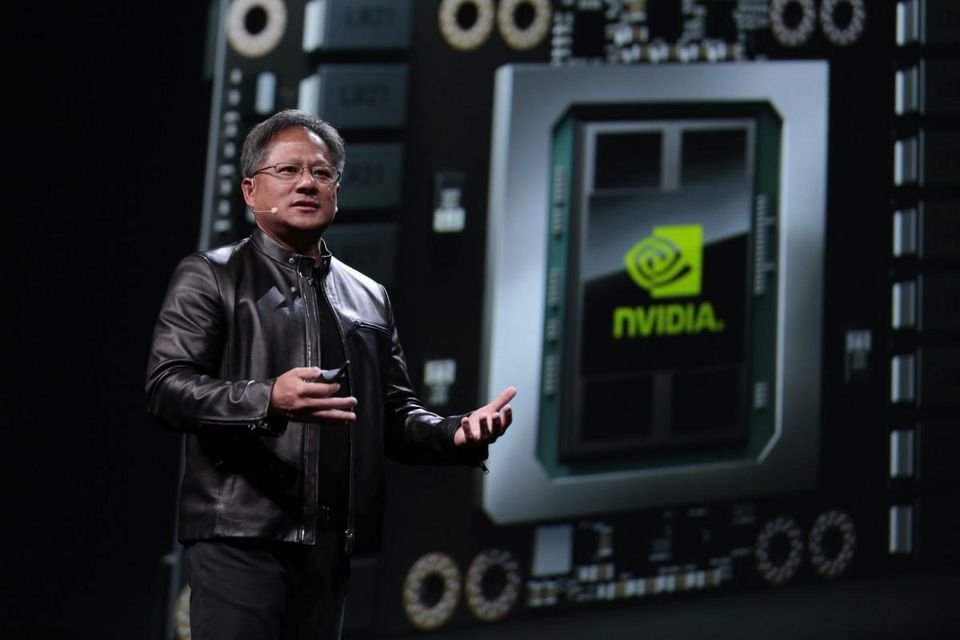

Nvidia was founded on April 5, 1993, by Jensen Huang (also the CEO and president since inception), a Taiwanese American, previously director of Core Ware at LSI Logic, and was a microprocessor designer at AMD. Chris Malachowsky, an engineer who worked at Sun Microsystems. Curtis Priem was previously a graphics chip designer and senior staff engineer at Sun Microsystems.

In the year of 1993, the three co-founders believed in an idea. Idea said that the right direction for the subsequent wave of computing is accelerated or graphics-based computing as this model of computing could solve problems that general-purpose computing fundamentally couldn’t.

They also observed that video games were simultaneously one among the foremost computationally challenging problems and would have incredibly high sales volume. The 2 conditions don’t happen fairly often. Video games became the company’s flywheel to succeed in large markets and funding huge R&D to unravel massive computational problems.

With only $40,000 within the bank, the corporate was born. The corporate subsequently received $20 million of risk venture capital funding from Sequoia Capital and other companies. Nvidia initially had no name and therefore the cofounders named all their files NV, as in “n0065xt version”. The necessity to include the corporate prompted the co-founders to review all words with those two letters, leading them to “invidia”, the Latin word for “envy”. Nvidia went public on January 22, 1999.

So it all started with graphic based computing models. The Company came up with release of capable graphics adapters:

i. RIVA TNT-1998

ii. GeForce 256 (NV10)- 1999

iii. GeForce2 GTS -2000

iv. Graphics processor (RSX) in the PlayStation 3 game console-2004

Nvidia in Artificial Intelligence

Nvidia is leading away in Artificial Intelligence Computing. Their GPUs simulate the human intelligence powering systems that can perceive and understand the world in a better way.

Nowadays Nvidia GPUs are used in deep learning, artificial intelligence, and accelerated analytics. The company developed its GPU-based deep learning in order to use AI so that it can approach and solve problems like cancer detection, weather prediction, and self-driving vehicles. These models are included in all Tesla vehicles. Adding that Nvidia GPUs work well for deep learning tasks. As they are designed for parallel computing and do well to handle the vector and matrix operations simultaneously that are prevalent in deep learning study.

Nvidia owes its success in data centers to the rising use of AI because videogame chips just happen to be suited thereto sort of computing. There’s a wonderfully good explanation for why this is often the case—I know this because sometimes people attempt to walk me through it, while I stare back at the sort of a dog watching Cirque du Soleil

Anyhow, Rolland says tons of companies try to form chips even better suited to AI but that Nvidia has created powerful software for programming its chips, called CUDA, making its role secure for now. Nvidia leads in what’s called multiprocessing, or performing many tasks at an equivalent time, whereas Intel (INTC) rules in data processing, or performing single tasks very quickly.

Earning of NVIDIA

NVidia’s earnings per share are expected to jump 40% to $8.15 this present fiscal year. Shares recently traded at surprising $370, or 45 times earnings. Data centers could be a $10 billion business for the company within these three years. Cars are still less than 1 billion USD.

Deal of Century

Huang at NVidia calls the deal with Mercedes a transformative moment for the company. Because the journey has gone from hardware for videogames, to hardware and software for AI, to new hardware, software, and services for cars. He also says that makes NVidia a platform company, not just a chipmaker. The first vertical market that NVidia chose is autonomous vehicles because the scale is so great. And the life of the car is so long that if NVidia offers new capabilities to each new owner, the economics could be quite wonderful. Curators believe that 2025 is the year until cars truly drive themselves.

1 Comment

Asking questions are in fact nice thing if you are not understanding

anything entirely, however this post gives good understanding even.

my blog post :: SITUS TOGEL HONGKONG HK TOGEL SINGAPORE