It’s really convenient to go cashless and it has been all because of such amazing cash apps which have made sending and receiving money, paying for your purchases, or splitting a bill with just your phone easier than it’s ever been.

Here’s what all you need to know about cash apps and how they make transferring money easier than ever.

What are cash apps?

Cash apps are apps designed to make payments using your phone. Cash Apps are the services that offer some unique options other than money transfer like investing in stocks, getting special savings with cash boosts, and commerce with bitcoin.

It is dependent on the app you download and your phone of course that you may be able to pay by tapping your phone at a point of sale than just by swiping a credit card. Other cash apps or phones that you downloaded could allow you to pay by displaying a code that the cash collector can scan.

Cash apps generally allow you to send money to your friends and family via an email address or a phone number and let you send money to your friends through social media, too.

Let’s check out how these cash apps work

Most of those cash apps allow you to form and receive payments free of charge if you’re employing a checking account or an in-app balance. However, if you are using a credit card to make a payment, there might be charges that you may have to bear while sending or receiving money.

Payment limits:

Additionally, there is a certain limit of each cash app and higher transactions than it may charge extra expenses. Also while moving the money out of your app account and into your bank account fees are charged that you need to keep in mind.

Benefits of using Cash apps:

Cash apps make payments easier

Rather than worrying about carrying around multiple credit cards or huge amounts of cash in different situations, you just need a cash app and store everything in it.

Security:

Another benefit related to using cash apps is that it’s secure, you don’t have to worry about canceling cards when you lose your wallet or purse. Even if you lose your phone somehow, as long as your phone is secured, you need not worry about someone else accessing personal payment information.

Cash apps are not suitable for everyone:

Cash apps are convenient for only some people. While those that struggle with technology may find these cash apps more difficult to use than the traditional payment methods.

You need to keep in mind multiple factors while looking for a cash app. First, you need to make sure the cash app is amicable with your phone. As Apple Pay, an app for iOS won’t work on Android. You need to inquire about the expense of using that cash app. Some of the cash apps are free, others may charge fees to send or receive the money you should have knowledge about it.

Now moving to further the article, let’s just know and review some of the most used cash apps:

Google Pay:

First up in the queue is Google Pay, which is the one that strikes you the first. Let’s check what Google Pay offers and is it the best cash app among various.

Google Pay, in short, can be considered the best cash app for Android users. It is amicable with both Android and iOS. If we consider the payment limits then you can send up to $9,999 in one transaction or up to $10,000 within seven days. Considering the cost to send money then Google Pay doesn’t charge any fees, but it also doesn’t allow you to use a credit card to send money to any of your friends and family.

For more information regarding the app, you can visit Google Pay.

Apple Pay:

A cash app for Apple users is Apple Pay, let’s check out this cash app can be considered as the best cash app for Apple users.

If we talk about compatibility then it is compatible with iOS. The payment limits are Up to $3,000 per message and $10,000 in a seven-day period. Now let’s see the cost of sending money. It is charging a 3% fee for amounts funded by credit cards to friends and family.

You can visit Apple Pay to learn more.

Samsung Pay:

Samsung Pay is compatible with: Select Samsung devices only. If we focus on the Payment limits then it’s none but it is a must to mention that this cash app doesn’t allow person-to-person transfers.

Moving on to the Cost to send money it’s also none and the same as it doesn’t allow person-to-person transfers. Moreover, Samsung Pay is great for Samsung users.

You can definitely visit Samsung Pay to learn more about it.

Paypal:

Afterward, it is PayPal known best for the low-fee transactions. Paypal is Compatible with both Android, iOS.

There are no payment limits on the money you can send from your verified account. You can send $60,000 but it may be limited to $10,000 in a single transaction.

The Cost to send money, if paying with a credit card, debit card, or PayPal credits you to pay 2.9% plus a fixed fee.

For more inquiries, you can visit PayPal.

Xoom:

Now, it is Xoom (A PayPal service) which is considered the best cash app for sending money to other countries. Xoom is unique in its idea as its purpose is to send money across countries.It is amicable with Android and iOS.

The Payment limits in Xoom are up to $25,000 per transaction. Initial limits are $2,999 in 24 hours, $6,000 in 30 days and $9,999 in 180 days.

Dealing with the cost to send money: The Cost varies depending on which country you’re sending money to.

Circle Pay:

The next one is Circle Pay, also known for sending money to other countries. This cash app allows you to send money to other countries in foreign currencies.

The Compatibility is with both Android, iOS.

The Payment limits are up to $400 per seven-day period. The limit can be raised to $3,000 per seven-day period by providing additional information.

Circle Pay doesn’t charge fees, but your bank may charge fees while sending money.

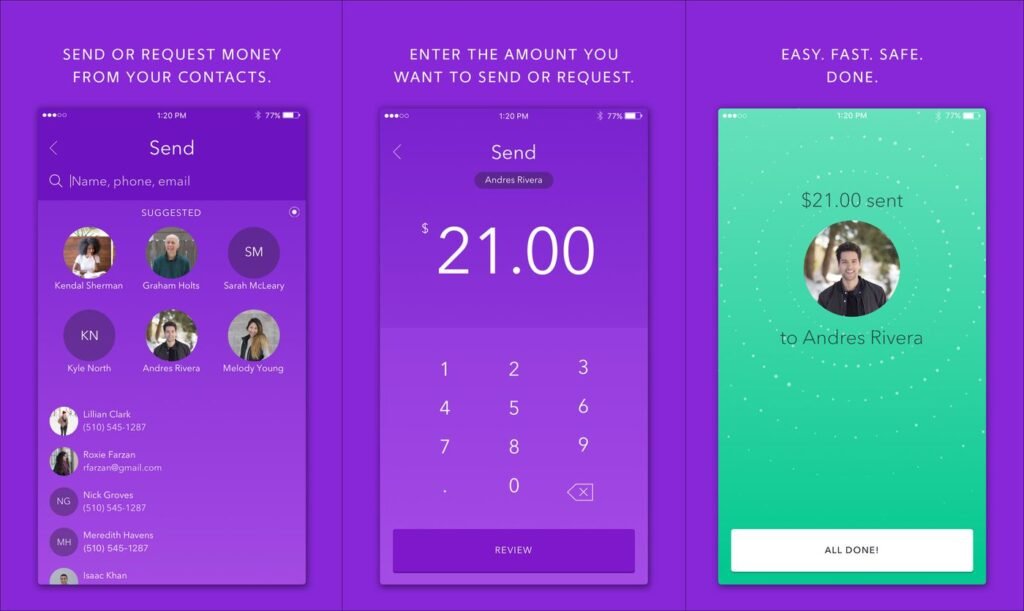

Venmo:

Next is, Venmo the cash app for sending small amounts of money

It is Compatible with: Android, iOS.

The Payment limits are $299.99 weekly, but can also be raised up to $2,999.99 per week.

The Cost to send money is $0 if purchasing from authorized merchants and 3% if paid by credit card and it is $0.25 to transfer Venmo balance out of Venmo only.

Square Cash:

Square Cash is also known for sending small amounts of money. It is compatible with both Android, iOS.

The Payment limits are the initial limit of $250 per transaction or a seven-day period. Also, the limits can be raised up to $2,500 per seven-day period.

If we talk about the Cost to cost of sending money then it is about a 3% fee if sending by credit card. The fee is added to the transaction total.

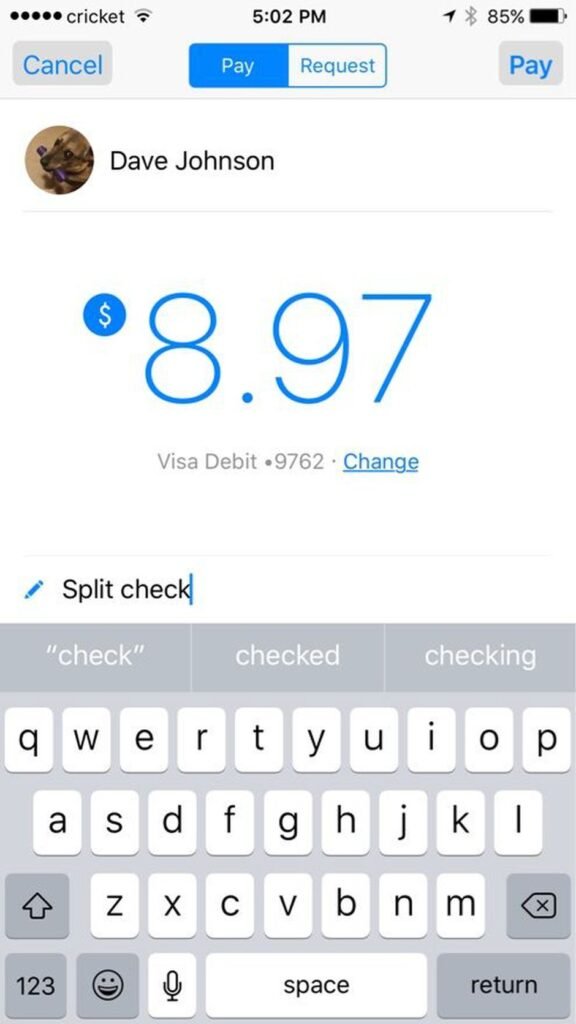

Zelle:

Next is Zelle, known for credit union members. Zelle is a different cash app as it is basically part of your bank’s or credit union’s app.

Its compatibility Depends on the bank or credit union’s app. If your bank or credit union doesn’t offer Zelle, your payment limit will restrict to $500 per week. If they do, you can directly contact your bank or credit union for changing the limits.

Zelle doesn’t charge fees as a cost to send money but your bank or credit union may.

Facebook Messenger:

Last, is Facebook Messenger known for no-fee transactions and Facebook fans. It is Compatible with: Android, iOS, and only users with a Facebook account.

The Payment limits are not disclosed.

The Cost to send money is not there, but users can only use a debit card or PayPal account to fund transfers.

1 Comment

Pingback: Openpay: An Interest Free Loan - Craffic